BlackRock and iShares are registered trademarks of BlackRock Inc., and its affiliates.

Fidelity may add or waive commissions on ETFs without prior notice. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain FBS platforms and investment programs. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from their use. Fidelity does not endorse or adopt their content. News, commentary and events are from third-party sources unaffiliated with Fidelity. Top basket holdings are as of the date indicated and may not be representative of the funds current or future investments. Since ETFs are bought and sold at prices set by the market - which can result in a premium or discount to NAV- the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). Life of fund figures are reported as of the commencement date to the period indicated. Cumulative total returns are reported as of the period indicated. Average annual total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Click on the "Performance & Risk" link to view quarter-end performance. Yield and return will vary, therefore you have a gain or loss when you sell your shares. Current performance may be higher or lower than the performance data quoted. The performance data shown represents past performance, which is no guarantee of future results. The top 10% of funds in each fund category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. (Exchange-traded funds and open-end mutual funds are considered a single population for comparative purposes.) It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a funds monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating TM for funds, or "star rating," is calculated for funds with at least a three-year history. **The Overall Morningstar Rating TM for a fund is derived from a weighted average of the performance figures associated with its 3-, 5-, and 10-year (if applicable) Morningstar Rating metrics, which are based on risk-adjusted returns. This chart is not intended to imply any future performance of the fund. Figures include reinvestment of capital gains and dividends, but do not reflect the effect of any applicable sales charges or redemption fees, which would lower these figures. *The chart illustrates the NAV performance of a hypothetical $10,000 investment made in the fund on or on commencement of operations (whichever is later). Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. ETFs are subject to management fees and other expenses. ETFs are subject to market fluctuation and the risks of their underlying investments. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal).

#Fidelity quick quotes free

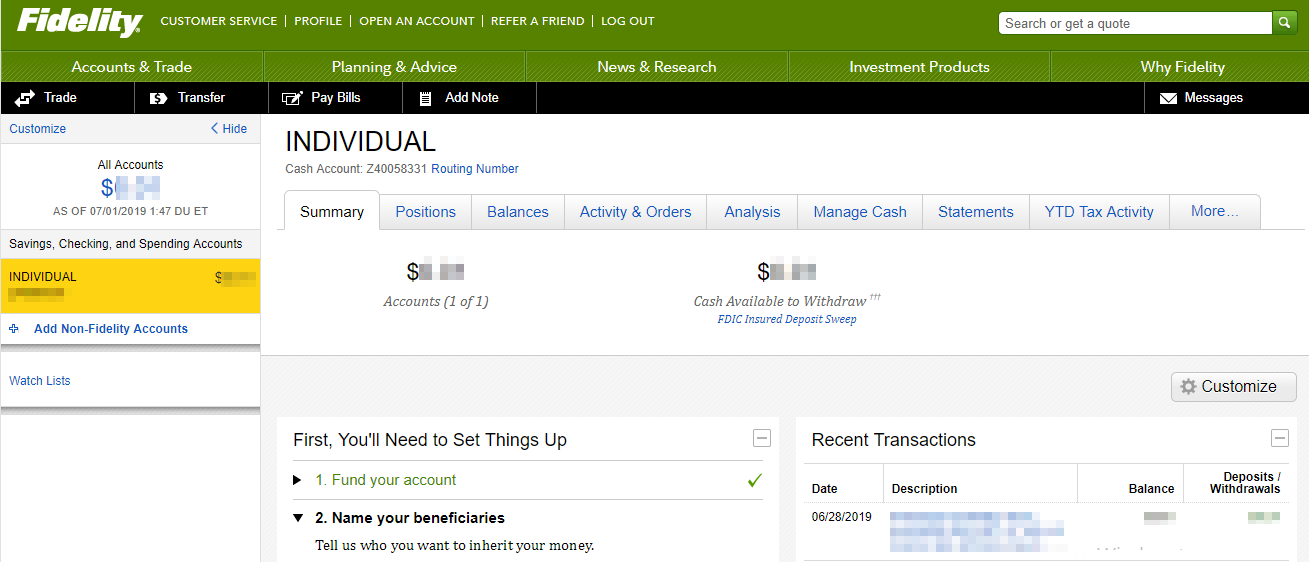

Free commission offer applies to online purchases select ETFs in a Fidelity brokerage account.

0 kommentar(er)

0 kommentar(er)